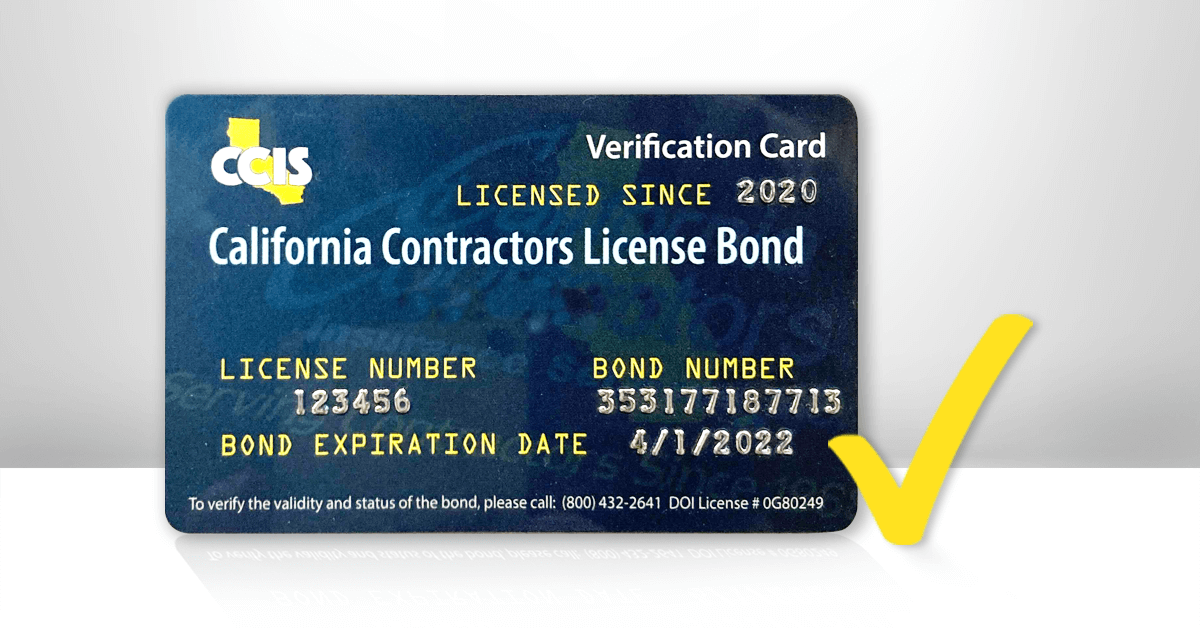

The California contractor license bond is a vital requirement for licensed contractors operating in the state. Regulated by the Contractors State License Board (CSLB), this bond ensures consumer protection and compliance with California's Contractor License Law. At CCIS, we specialize in providing the contractor bond California contractors need to stay licensed and protected.

Why a Contractor License Bond Is Required in California

The CSLB, which licenses and regulates more than 285,000 contractors in California, mandates the contractor license bond California contractors must carry. This $25,000 bond is a safeguard for consumers, vendors, suppliers, and employees, providing financial compensation for damages due to the failure of contractors to meet legal or contractual obligations.

Unlicensed contractors do not carry this bond, leaving consumers unprotected in the event of disputes or damages. Operating as an unlicensed contractor can also lead to significant consequences, including fines, imprisonment, and felony charges—all enforceable under the California Business & Professions Code 7028.

How a California Contractor License Bond Works

The California contractor license bond serves three distinct parties:

- Principal: The licensed contractor obtaining the bond.

- Obligee: The CSLB, which requires the bond as a condition of licensure.

- Surety: The insurance company issuing the bond and guaranteeing its terms.

The surety guarantees up to $25,000 in coverage for valid claims resulting from a contractor's failure to comply with California Contractor License Law. These claims may involve unpaid workers/vendors, contract abandonment, or faulty workmanship. Contractors are ultimately responsible for reimbursing the surety for any claims paid.

Contractors with contractor license bonds in California demonstrate accountability and financial responsibility, which helps build trust with clients and authorities alike.

Cost of California Contractor License Bonds

The cost of a contractor license bond in California varies based on factors like personal credit, license history, years in business, and type of contractor classification. Below is an example of pricing tiers for a $25,000 bond:

| Price Tier | Bond Cost* |

|---|---|

| Ultra-Preferred | $109 |

| Preferred | $165 |

| Standard | $275+ |

| Credit Repair | $1500+ |

*Prices shown are for the one-year term and are based on several factors, including personal credit, license history, years in business, and active licensing and bonding. Not all available pricing tiers are shown. Rates do not constitute an offer of bonding and are subject to change at any time.

A Credit Check Is Required

Surety carriers conduct a soft credit check during the underwriting process. This does not affect your credit score but helps determine bond pricing based on your ability to reimburse claims if necessary. CCIS works with reputable surety companies with flexible credit risk policies, ensuring you obtain your bond at the lowest possible rate. If you have poor credit, don't worry—CCIS partners with multiple surety companies offering competitive rates for all credit tiers.

How CCIS Helps California Contractors

At CCIS, we specialize in securing California contractor license bonds for contractors quickly and affordably. Here's what makes us the go-to provider:

- Expertise: More than 55 years of industry leadership in serving contractors.

- Competitive Pricing: Our partnerships with major surety carriers let us deliver the lowest rates in the market.

- Fast Service: Get bonded in minutes with our streamlined online application process.

We're proud to support California contractors with all their licensing and bonding needs.

Additional Surety Bonds for California Contractors

Along with the $25,000 California contractor license bond, some contractors may require additional bonds based on licensing and circumstances:

- $25,000 Bond of Qualifying Individual: Required for certain contractor license types.

- $100,000 LLC/Employee Worker Bond: For contractors operating as LLCs.

- Disciplinary Bond: Required for contractors facing CSLB disciplinary actions.

- Bid, Performance, and Payment Bonds (Contract Bonds): Often required on a job-by-job basis for specific projects.

Not sure which bond you need? Contact our team for expert assistance.

How to Check a Contractor's License or Bond Status

Consumers can verify a contractor's license and bond status using the CSLB license database. Visit the CSLB website and enter the contractor's license number to confirm licensing and bonding. License verification protects consumers by ensuring contractors meet the state's legal requirements.

Frequently Asked Questions: California Contractor License Bond

What is a contractor license bond?

Who needs a California contractor license bond?

How does a bond differ from liability insurance?

What happens if a claim is filed against my bond?

Secure Your California Contractor License Bond at CCIS

At CCIS, we make obtaining your California Contractor License Bond fast, affordable, and hassle-free. Don't let bonding requirements delay your projects or licenses. Our dedicated team is here to ensure you get the most affordable rates and best service in the industry.